Read time: 2 to 3 minutes

Catch-up contributions allow you to save more in your retirement plan! In fact, if you’re age 50 or older and want to save as much as you can, catch-up contributions could be your new best friend. We’ll tell you why in this article.

They can help you get back on track

Many of us got off to a slow start saving for retirement. Fortunately, most retirement plans allow for catch-up contributions later on.

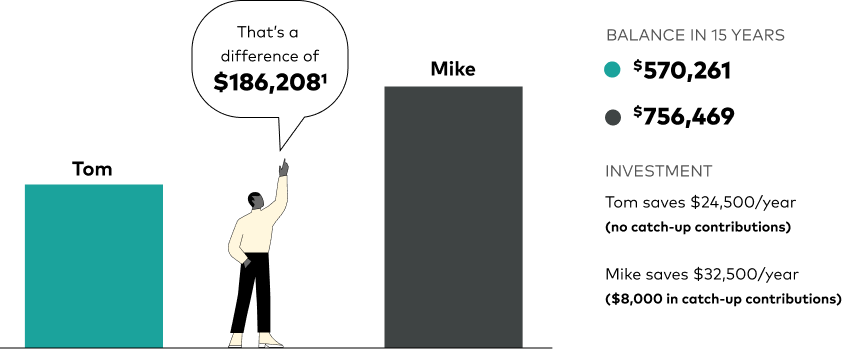

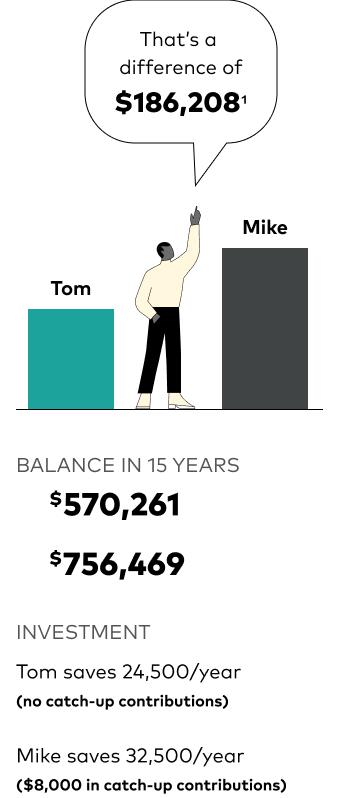

In 2026, you can save up to $24,500 each year in your employer’s retirement plan. And if you’re age 50 or older, you can save up to an extra $8,000 in catch-up contributions.

Note: In 2026, if you're ages 60 to 63 on the last day of the calendar year and your plan allows, you may be able to save an additional $3,250 in catch-up contributions.

If you have a traditional or Roth IRA, your contribution limit is $7,500. And if you’re age 50 or older—and meet the income requirements—you can make a catch-up contribution of $1,100 for a total of $8,600.

Are you a high-income earner?

Starting in 2026, you may be affected by a new provision of the SECURE 2.0 Act. If you earned more than $150,000 in FICA wages in the previous calendar year (Social Security wages in Box 3 of your W-2), any catch-up contributions you make to your retirement plan must be Roth (that is, made with after-tax money).

The $150,000 amount will be indexed for inflation once effective, so it is likely to increase in future years. Only compensation from the employer sponsoring the plan counts toward this limit. Please note that catch-up contributions to IRAs are not affected by this rule.

Note: Some retirement plans don’t offer Roth contributions. If your plan doesn’t offer Roth and you earned more than $150,000 in FICA wages with your current employer in 2025, you won’t be able to make catch-up contributions to your plan in 2026.

They can give you more retirement income

All that extra savings adds up. By the time they retire at age 65, Mike will have $186,208 more in savings than Tom.1 But here’s the important part. Extra savings will mean extra income for Mike. Mike will have almost $7,500 more a year in retirement income than Tom, assuming they each withdraw 4% of their savings each year.