What do you get?

Take a sneak peek

Vanguard Digital Advisor can help simplify your life today—and give you greater peace of mind for your future. Here’s a quick preview of what Digital Advisor can do for you:

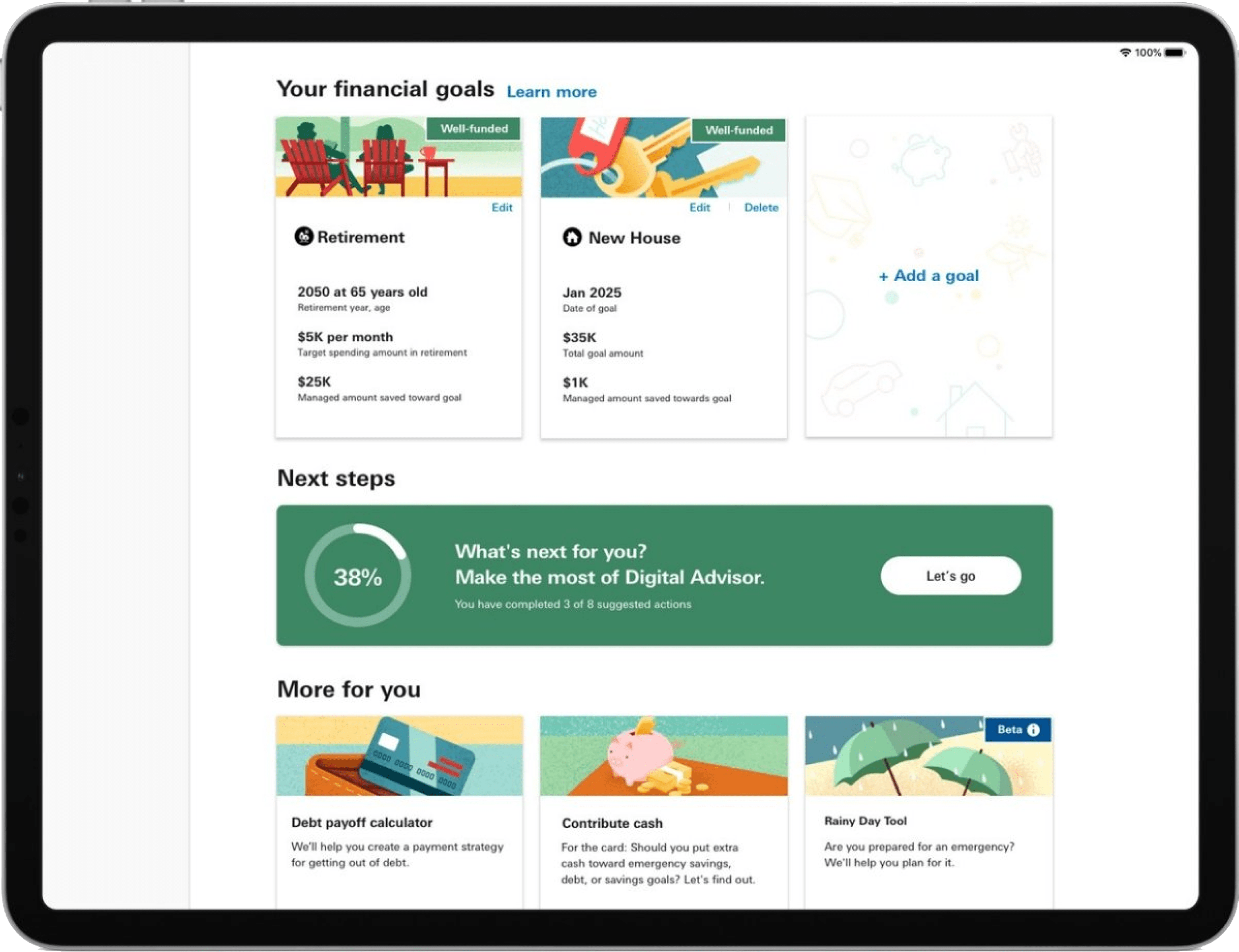

Help with retirement … and so much more

We know that retirement is just one part of your financial life. So we’ll also help you pay down your debt, build up your emergency savings, and save for any financial goal—like buying a house or paying for college.

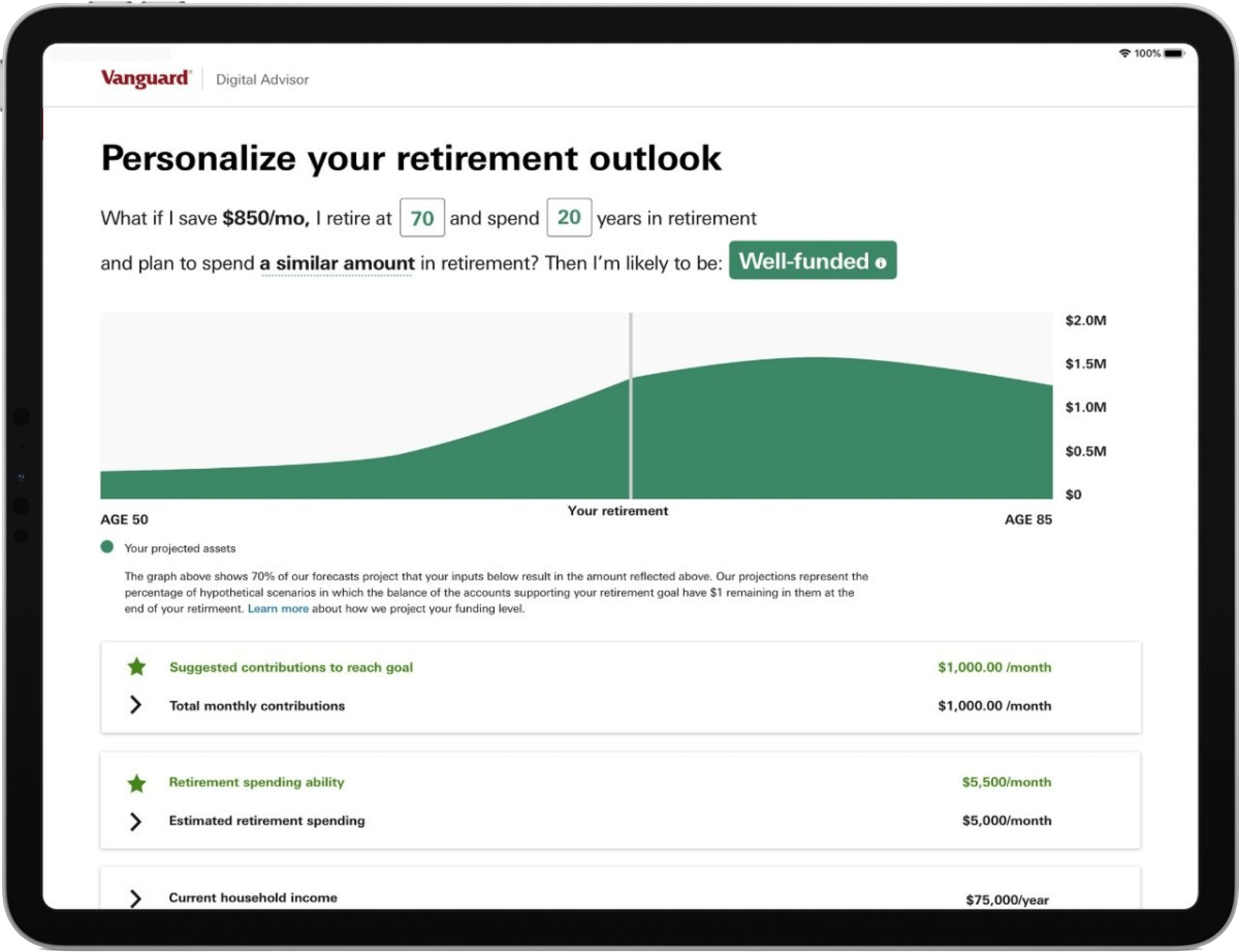

Create a financial plan just for you

We’ll build a savings and investment plan based on your unique financial situation and goals. Then we’ll put that plan into action by investing your money and bringing you closer to those goals.

Give you confidence in your plan

Can your investments weather the market’s ups and downs? To see how likely you are to reach your financial goals, we’ll run your plan through thousands of market scenarios.

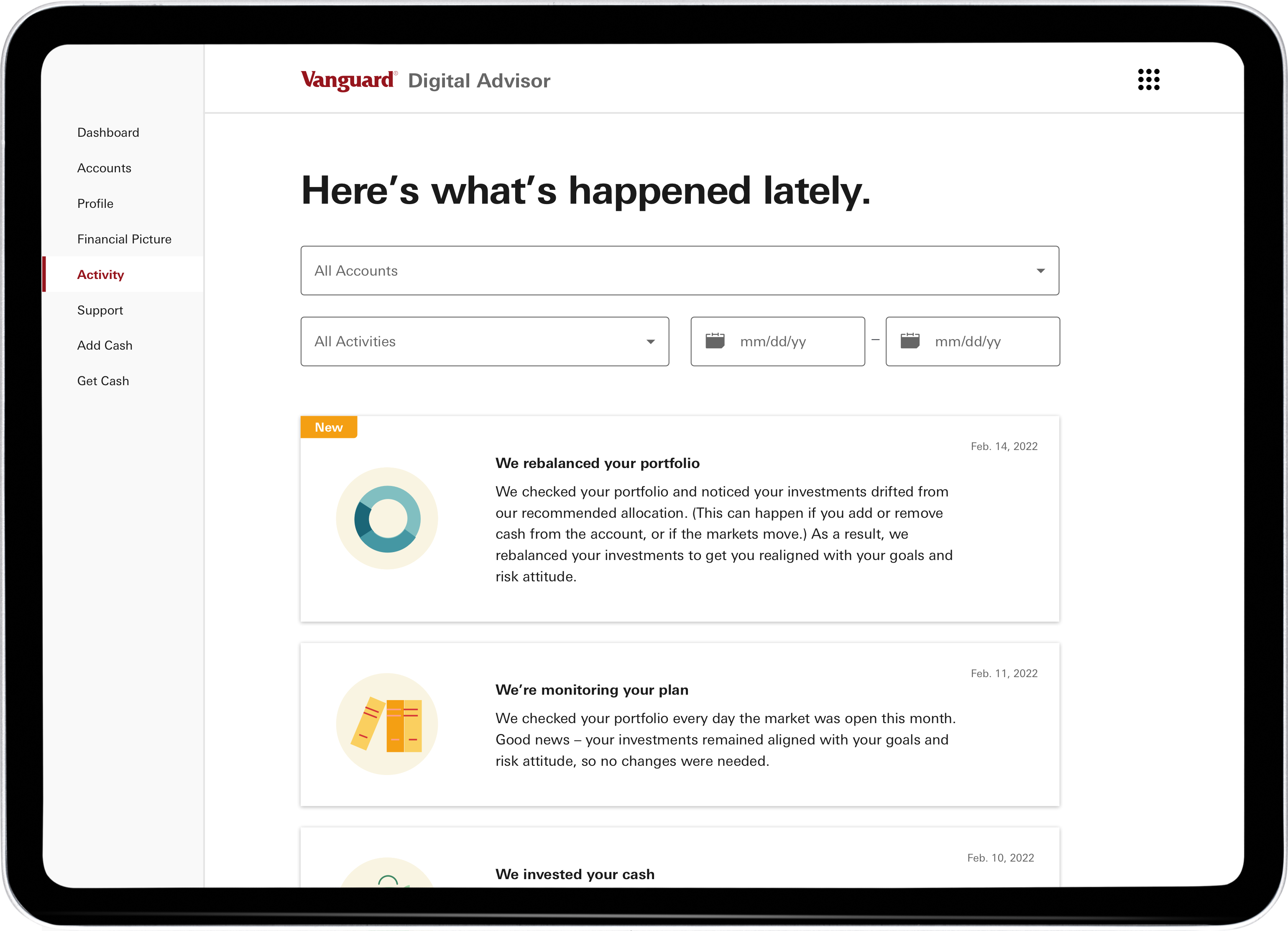

Rebalance and keep you on track

We’ll check your investment mix each business day and rebalance as needed, so you don’t have to.

And of course, we’ll let you know if we make a change and update you along the way.

Caring for your portfolio

Rebalancing your portfolio regularly will help your investment mix stay on target in any type of market. See how Digital Advisor will do the work for you—so you can spend more time doing the things you like.

Caring for your portfolio

Rebalancing your portfolio regularly is an important part of investing, and we’ll show you how Digital Advisor takes the time and guesswork out of it.

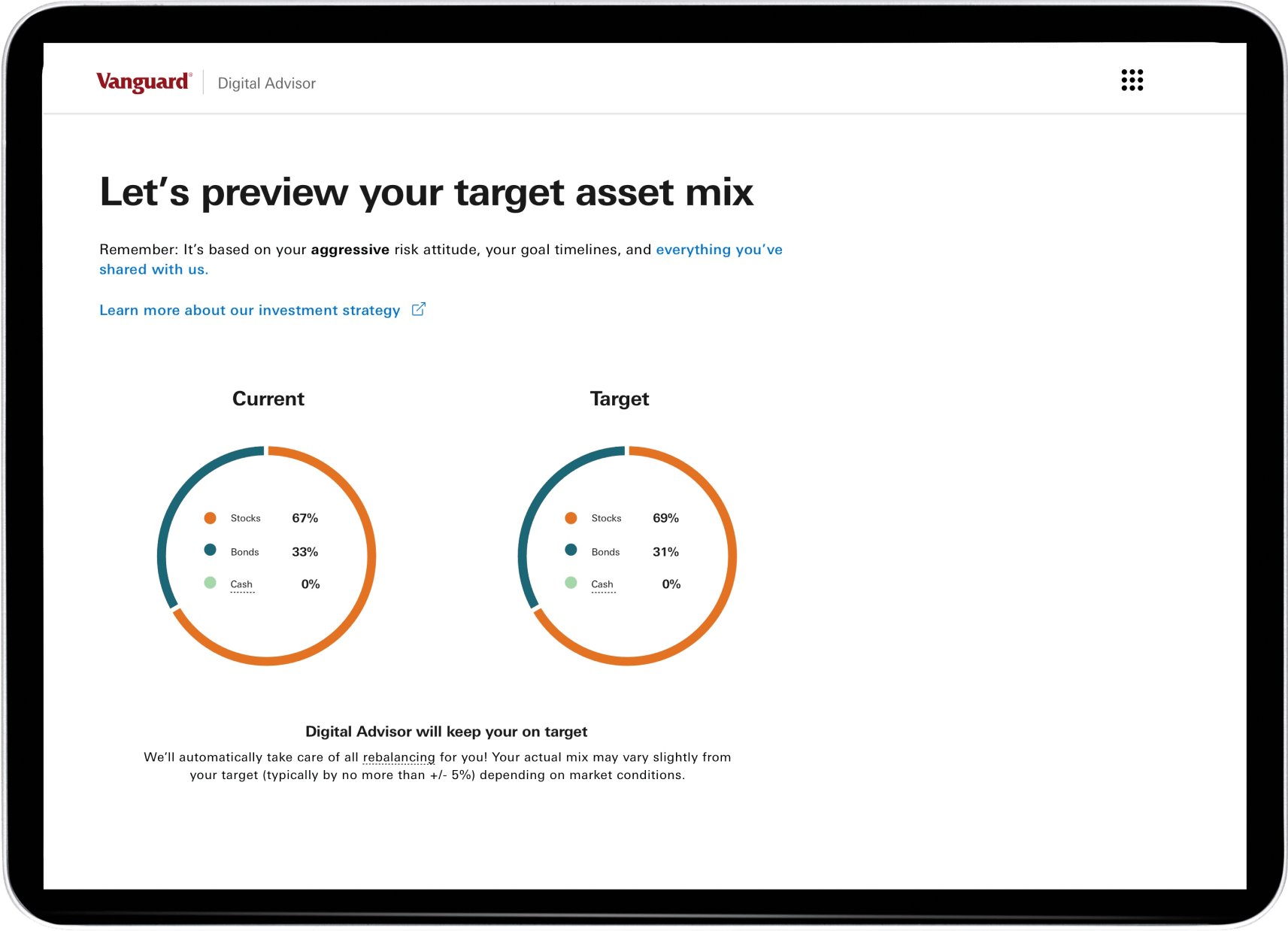

But first, what is rebalancing? It means making sure that the mix of stocks, bonds, and other assets in your portfolio stays on target. Your asset mix is important because it determines the amount of risk you take on when you invest. Too much risk, or too little, can put your investment goals in jeopardy.

Everyone’s ideal mix is different and Digital Advisor can help you find and stick to yours. To keep your portfolio on track, Digital Advisor typically checks your investments every day that the market is open. It will automatically rebalance for you whenever your stock and bond holdings have shifted more than 5% from the asset mix you’ve chosen. Shifts like this can happen because of normal market ups and downs, which can cause the value of your stock or bond holdings to change significantly.

Digital Advisor is always looking out for you by making sure your portfolio stays aligned with your risk tolerance. Stress-free rebalancing is a beautiful thing. If only everything in life were this easy.

The legal details

Whenever you invest, there’s a chance you could lose the money.

There is no guarantee that any asset allocation or any particular mix of funds will meet your investment objectives or provide you with a given level of income. Diversifying means having different types of investments. It doesn't guarantee you'll make a profit or that you won't lose money.

Bond funds are made up of IOUs, primarily from companies or governments. These funds risk losing value if the debt isn't repaid on time. Also, bond prices can drop when interest rates rise or the issuer's reputation suffers. Non-U.S. stocks or bonds have risks tied to the political and economic stability of their country or region. And if the value of the foreign currency falls, the value of the stocks or bonds would also fall.

Collective trusts are not mutual funds. They're a special type of investment offered only in retirement plans like yours. Before you invest, get the details. Know and carefully consider the objective, risks, charges, and expenses. Vanguard Fiduciary Trust Company manages the Vanguard collective trusts.

Vanguard Digital Advisor's services are provided solely by Vanguard Advisers, Inc. (VAI), a registered investment advisor. Go to vanguard.com/legalbrochure for important details about this service. Vanguard Digital Advisor's financial planning tools provide projections and goal forecasts, which are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

© 2023 The Vanguard Group, Inc. All rights reserved.